20 Mar 2025 Fashion Forecast: Pressure, Shifts, And Strategy

KEY INSIGHTS

- 80% of fashion executives expect no improvement in 2025.

- Sustainability has dropped in priority: only 18% of industry leaders rank it among the top three growth risks, down from 29% in 2024.

- 70% cite declining consumer confidence and spending restraint as their primary concerns.

A CHALLENGING YEAR AHEAD

Even in stable times, fashion remains notoriously unpredictable – and 2025 promises heightened volatility. Cyclical economic downturns, persistent inflation, counterfeit surges, and evolving global trade dynamics continue to weigh heavily on the industry.

SLOW GROWTH TO CONTINUE

- The fashion industry is likely to extend its sluggish performance into 2025, mirroring 2024. According to the annual BoF–McKinsey survey, 39% of executives expect conditions to worsen, while only 20% anticipate improved consumer sentiment.

- Geographically, the sector may benefit from easing inflation and rising tourism in Europe, the resilient spending power of the U.S. upper class, and new growth momentum in Asia. While China remains a key market, macroeconomic uncertainty is pushing brands to shift focus to alternative Asian hubs — including Japan, South Korea, and India.

SPOTTING OPPORTUNITIES

- To connect with evolving consumers, brands are expected to refine business models, broaden pricing strategies, and strengthen brand positioning. This shift fuels the rise of resale and off-price segments. Brands choosing not to enter these categories must clearly justify their premium value proposition.

- Brick-and-mortar retail is rebounding to pre-pandemic levels, requiring enhanced in-store experiences. As physical retail recovers, 2025 may also bring a structural reset to mass-market e-commerce platforms.

9 TRENDS DEFINING FASHION IN 2025

1.Rewiring Trade:

Major economies are diversifying supply chains and sourcing from politically aligned nations, reconfiguring the map of global production.

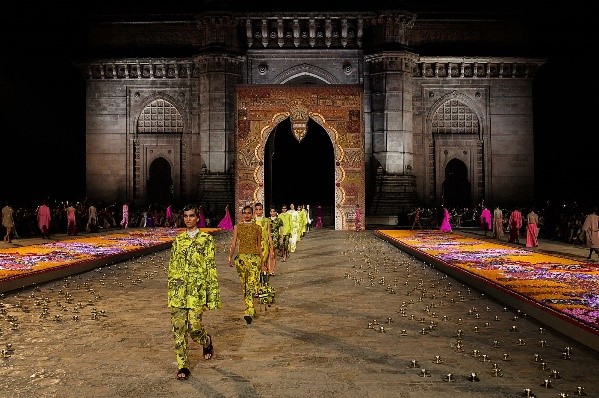

2.Asia’s emerging growth hubs:

With China’s growth slowing, brands are shifting attention to markets like India, Japan, and South Korea.

Dior Fall 2023 show in Mumbai — spotlighting India’s new luxury fashion role

3.Redefining product discovery:

Consumers are overwhelmed by choice. AI-driven tools will streamline product discovery and personalize content for better shopping experiences.

4.The rise of the “Silver Consumer”:

Shoppers aged 50+ now account for a significant portion of fashion spending. Brands must adapt strategies and product offerings to serve this increasingly influential demographic.

The “Silver Generation” commands growing global spending power

5.Value- driven consumption:

Consumers are prioritizing value, accelerating growth in off-price, resale, and premium counterfeit markets.

6.The human factor in retail:

In-store service quality becomes critical. Empowering retail associates to deliver personalized experiences will be key.

75% of shoppers spend more after receiving high-quality service, according to the BoF –McKinsey 2025 State of Fashion Report

7.Disruption of e-commerce platforms:

Mass-market e-commerce players face pressure to reinvent their role in the fashion ecosystem amid changing consumer habits.

8.Smarter inventory management:

Brands are embracing tech and operational innovation to reduce overstock, minimize waste, and improve profitability.

9.Sustainability remains non- negotiable:

Even as consumers remain hesitant to pay more for sustainable goods, regulatory and climate pressures demand continued action from fashion leaders.

(Source: Business of Fashion)